There is a glimmer of hope for Nigerian consumers since Nigeria’s inflation rate slowed in February 2025, showing a potential reversal of economic trends.

According to the latest figures released by the National Bureau of Statistics (NBS) on Monday, Nigeria’s headline inflation rate decelerated to 23.18% year-on-year, from 24.48% in January.

The decline comes just a month after the NBS rebased its Consumer Price Index (CPI) to better reflect changes in consumer spending and behavioral patterns.

In February 2025, the headline inflation rate decelerated to 23.18% relative to the January 2025 headline inflation rate of 24.48%,” the NBS stated. “On a year-on-year basis, this is a 8.52 percentage point decrease relative to 31.70% in February 2024.”

Why the Decrease Matters

This fall is significant not only because it signals a slowdown in the pace of price increases but also because it follows years of speeding inflation that reached a 28-year high in 2024.

Much of that acceleration was triggered by some heavy policy adjustments that followed quickly after President Bola Tinubu took office in 2023, including the removal of fuel subsidies and the unification of several exchange rates—both of which caused living costs to spiral.

The rebasing of the CPI, which makes 2024 the new base year (as opposed to the previous 2009 benchmark), has assisted in reindexing the calculation of inflation to potentially provide a more accurate reflection of current economic conditions.

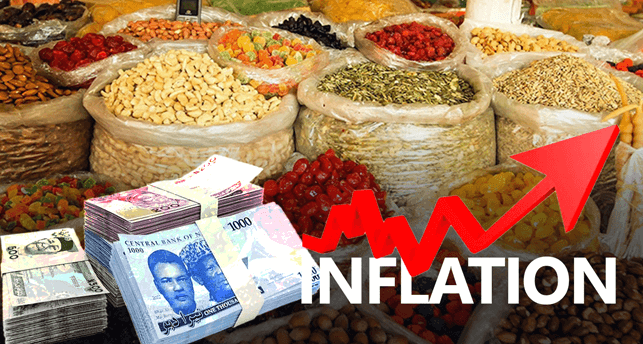

Food Inflation Also Eases — But Still a Concern

One of the most closely followed statistics in Nigeria is food inflation, and this also showed an improvement. Food inflation slowed to 23.51% year-on-year in February 2025, a big fall from the 37.92% in February 2024.

However, the NBS notes that part of this steep drop is technical, due to CPI rebasing. Even then, on a month-to-month basis, food inflation stood at 1.67%, reflecting slightly reduced prices for staples like yam tubers, maize flour, cassava, potatoes, soybeans, and bambara beans.

That said, the 12-month moving average food inflation rate remains elevated at 34.74%, 4.67 percentage points higher than last year’s average—a reminder that food insecurity and affordability remain pressing concerns.

Policy Outlook: Is the Tide Turning?

The Central Bank of Nigeria (CBN) is cautiously optimistic. At its first Monetary Policy Committee (MPC) meeting of the year, the CBN decided to keep interest rates unchanged after a series of hikes in 2024 aimed at reining in inflation.

The central bank cited exchange rate stability and the recent moderation in inflation as reasons for not moving, pointing to policymakers waiting to observe how these developments play out in the months ahead.

What’s Next?

While the latest inflation figures provide a breath of relief, there is still much to be accomplished on the path to economic recovery. Reducing inflation does not always mean falling prices—it only means prices are rising more slowly than before.

The NBS numbers have a cautiously optimistic tale to tell, but to the average Nigerian, the pinch of high living costs is all too real. Whether this downward trend is maintained or not will be the outcome of a mix of monetary policy, exchange rate stability, and supply-side reforms.

However, after many months of economic uncertainty, this downward trend in inflation is a welcome twist—and one worth watching very closely.

Leave a Reply