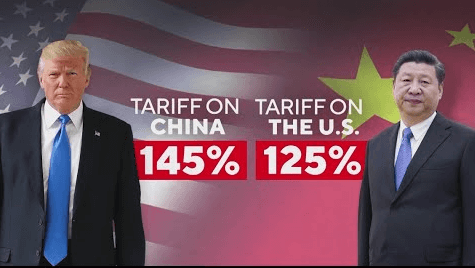

President Donald Trump remains adamant that his policy of tariffs is paying dividends and ultimately will be in his country’s, as well as the remainder of the world’s, best interest – even as China escalates the trade war by raising tariffs on American products to 125%.

Global financial markets reacted with pandemonium. Stock markets careened out of control, the U.S. dollar fell, and government bonds came under new pressure following Beijing’s retaliatory move, further escalating tensions between the two biggest economies in the world.

Trump took to Twitter on Friday and doubled down on his approach, stating, “We are doing very well on our tariff policy. Very exciting for America, and the World!!! It is moving along very quickly.”

Last week, Trump shook financial markets by revealing sweeping tariffs on imports from various countries, only to partially back off midweek—lowering them to 10% for most but raising them on China. The temporary boost to investor confidence evaporated as it became clear that the trade battle with Beijing was far from subsiding.

Xi Responds

Chinese President Xi Jinping finally weighed in on rising trade tensions during a meeting with Spanish Prime Minister Pedro Sanchez, declaring China is “not afraid” and calling for the EU and China to “jointly resist unilateral bullying practices.”

Later, Beijing announced new 125% tariffs on U.S. imports will take effect Saturday, bringing them almost to the 145% tariffs China imposed on American products.

China’s Commerce Ministry Spokesman was quoted to have blamed the U.S. in entirety for the escalation, labeling Trump’s tariff proposal as a “numbers game” to “become a joke.” China’s Finance Ministry also added that there will be no additional tariff hikes planned, acknowledging that such high levels make further imports almost impossible.

Diplomacy on Hold

Even as tensions smoldered, Trump was sounding optimistic about eventually signing a deal with Xi, referring to the Chinese president as a “friend” and a potentially mutually beneficial deal. U.S. officials indicated, however, that they expect Beijing to take the first step toward opening the next round of talks.

Meanwhile, Trump faces mounting pressure as markets remain edgy. Yields on the most significant U.S. government securities continued rising Friday, which is an indication of waning investor confidence.

Trump acknowledged spreading jitters conceded, admitting to having seen investors get “queasy” in the bond market before deciding to roll back part of his tariff hike.

Economic Warning Signs

There’s growing rumor that China will be selling off portions of its massive U.S. debt holdings in retaliation—a move that will cause the United States government to pay higher borrowing costs. The dollar hit a three-year low against the euro, as gold rallied on the back of investors rushing to safe haven assets.

Simultaneously, Federal Reserve officials cautioned that Trump’s tariffs policies have the capacity to push inflation upward and cut economic growth.

Economists also cautioned that prolonged disruption between the highly interdependent U.S. and Chinese economies has the potential to push consumer prices upward and possibly trigger a global recession.

Swissquote analyst Ipek Ozkardeskaya summed up the sentiment, saying the new tariff levels are “so high that they don’t make sense any more,” but said China appears “willing to go as far as required.”

Leave a Reply