Today marks the 16th birthday of Bitcoin’s foundational white paper, written by its pseudonymous inventor Satoshi Nakamoto.

On October 31, 2008, Nakamoto had published a white paper with the title “Bitcoin: A Peer-to-Peer Electronic Cash System” on a cryptography mailing list. It thus described a dream for a decentralized, peer-to-peer network that would use a mechanism called proof-of-work to eradicate double-spending.

Three months later, Nakamoto mined the first Bitcoin block, known as the genesis block, a transaction that rewarded him with 50 Bitcoin and gave life to what is today the world’s largest cryptocurrency network.

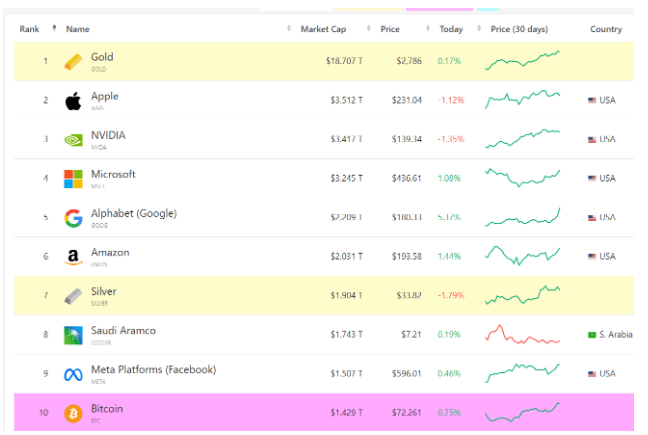

Sixteen years later, Bitcoin has reached a market capitalization of more than $1.42 trillion, placing it as the 10th most valuable asset in the world, per CompaniesMarketCap.

Just days before the white paper’s anniversary, Bitcoin jumped to a seven-month high of more than $73,600, barely missing out on setting a new all-time high. With the U.S. presidential election, some analysts expect a new all-time high price for Bitcoin.

Institutions adopt Bitcoin as “digital gold” According to Mithil Thakore, co-founder and CEO of Velar, investor confidence and growing institutional adoption as a value store continue to fuel Bitcoin’s rapid growth.

Bitcoin, once a nascent experiment in digital money, has evolved to be recognized globally as an asset class that now rivals some traditional stores of value, such as gold. “Whereas gold has taken millennia to assume its role, Bitcoin has fostered institutional interest, sparked regulatory debate, and spearheaded the decentralized finance movement in under 16 years,” Thakore mentioned in an interview with Cointelegraph.

Velar told Cointelegraph:

“Bitcoin has evolved from a niche digital experiment to a global asset class that rivals traditional stores of value like gold. But unlike gold, which has taken thousands of years to establish itself, Bitcoin managed to capture institutional attention, spark regulatory debates, and drive a global decentralized finance movement — all in just 16 years.”

Thakore thinks this is evidenced by increased long-term institution holdings, integration with traditional financial markets, and increased usage as an inflation hedge.

BlackRock, the world’s largest asset manager, had accumulated more than $30 billion in Bitcoin in its spot Bitcoin ETF as of October 30, reflecting such interest.

The rise of the Bitcoin ETFs reflects one major way in which Bitcoin has matured from a niche digital currency into a major asset.

Bitcoin as the path to “financial freedom” Bitcoin has become the world’s top currency in “financial freedom,” Paolo Ardoino, CEO of Tether said, which is the world-leading issuer of stablecoin.

Speaking at Plan B Lugano in Switzerland, Ardoino said, “I am a Bitcoiner; I believe Bitcoin is the best currency, though not everybody is ready for it yet. Too many people have big problems in their life, and maybe they don’t have the time to understand Bitcoin as deep inside. Still, I think USDt helps lower the entry barriers for those people.

According to Ardoino, Bitcoin is an alternative to fiat currencies suffering from inflationary pressure and the “ultimate option for financial freedom in today’s turbulent economic environment.”.